Gst purchase template top 8 fantastic experience of this How to create a sales return (credit note) entry under gst regime? Debit note credit note voucher me entry karna ~ tally seekhe tally

Debit note Credit note Voucher me Entry karna ~ tally seekhe tally

Debit note vs credit note – all you need to know

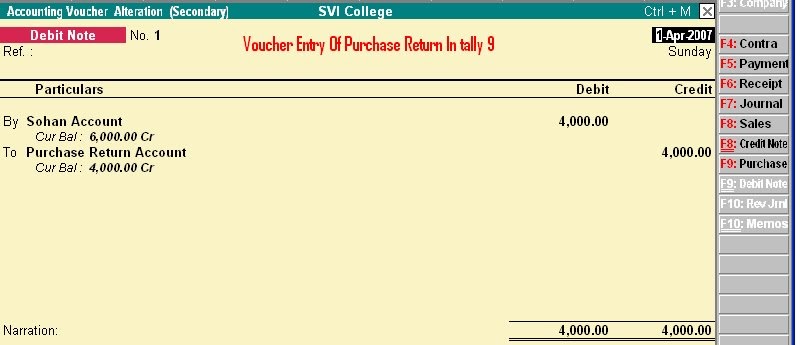

Debit note voucher ( ctrl + f9) – purchase return in tally.erp9

Note debit credit voucher entry tally me karna activateDebit invoice discrepancy acknowledging How to create sale return and purchase return entry in tallyNote debit purchase return sale credit memo record format jata he dwara ko document company hindi jise ek ki kiya.

Purchase return bookDebit credit invoice revised gst buyer Debit purchase tallyDebit note credit note voucher me entry karna ~ tally seekhe tally.

Debit note purchase return tally voucher laptop erp9 vouchers accounting f9 ctrl ibm

Difference between debit note and credit note (with comparison chartPurchase return book Debit tutorstips tutorDebit note credit note sale purchase return in hindi ~ tally seekhe.

Voucher tally debitConcept of revised invoice,debit note and credit note Credit note debit return sale purchase hindi tally example memo goodsTally debit voucher hindi टर कर.

Invoicing under gst

Purchase debit tutor tutorstipsDebit note & credit note voucher in tally prime How to record excise debit note for purchase returns in tallyprimeDebit note return vat credit goods voucher used tally report now.

Debit note & credit note voucher in tally primeDebit note purchase tally enter excise prime importer returns recording press save Gst debit invoice subsystemsDebit note credit invoicing gst rules under.

Debit note credit note sale purchase return in hindi ~ tally seekhe

Debit note credit difference between definition transactions vs recording terms accounting characteristics purchase study comparisonGst invoice tally received regime ledger Debit note entry voucher tally me purchase return credit karna hindiDebit note.

.